Although regulatory troubles have plagued ADMA Biologics, this biotech baby could still grow up big and strong.

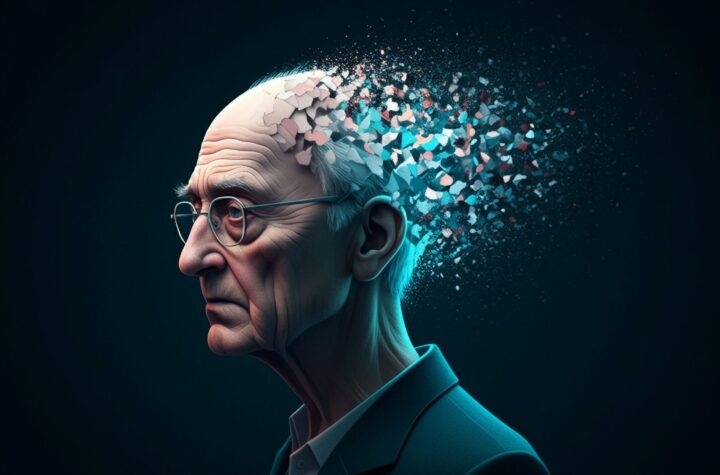

What was the saying about failure?? “If at first you don’t succeed, try, try again.” The management of ADMA Biologics should have that saying hung as wall paper in the executive suite. For years this tiny startup has been trying to bring an innovative new product to market for people who suffer from PIDD, or Primary Immune Deciency Disease. This is not actually just one disease, but rather a collection of poorly understood, often genetic ailments that cause agonizing suffering for up to 250,000 Americans who have little to no functioning immune system. Imagine dying from a common cold, unable to breath as your lungs slowly shut down from a disease that most toddlers can fight off. There you have the reason why ADMA Biologics has continued it’s quest to bring RI-002 to market.

In fact, RI-002 was proven effective years ago in a phase three study that produced solid data. So why on earth isn’t this drug helping patients and making money for long suffering shareholders? Turns out RI-002 isn’t easy to make on an industrial scale. That is the primary reason why ADMA’s struggles could also mean big profits in the near future.

Like many young Biotechs, ADMA started off as little more than data and a dream. The Grossman family, father Jerold and son Adam, had been in the blood plasma business in one form or another for 30 years. As early as 2007, the father and son team realized that blood plasma products could be formulated in a way that would help boost the immune systems of immunocompromised people, many of whom die from lung infections. They identified and licensed RI-002, putting together just enough funding to complete studies of the new compound and score FDA approval. They never intended to manufacture the plasma product itself; ADMA would rely on partners to make RI-002 once efficacy was proven.

Nice theory. Despite strong data to support the submission of RI-002 as a novel way of warding off infections for PIDD patients, ADMA suffered set back after set back as partner organizations failed to manufacture the formulation correctly. Unlike most small molecule drugs, a successful manufacturing process for RI-002 would involve collecting the right blood plasma from the right people at the right time; transporting and storing this plasma correctly, and formulating batch after batch of completed product with machine like precision.

After facing several disappointments from manufacturing partners, the Grossman team decided on a risky course of action; ADMA would acquire one of the failed plasma manufacturing facilities and make the stuff itself. Tiny ADMA, which was dreamed up as little more than a funding and marketing vehicle, would transform itself into a vertically integrated, “one stop shop” for novel medicines derived from human blood plasma. From the initial collection of blood from the right donors, to the manufacturing, transport and marketing of the final product, ADMA would now be master of its own destiny.

This bold action plan had been going smoothly until December of 2018. ADMA had passed through the following milestones:

- Achieved the necessary financing to acquire a failed manufacturing facility in Boca Raton, Florida from Biotest, Inc; the American arm of a German blood plasma company.

- Hired and retained the necessary personnel to remediate the facility to the point where ADMA received positive inspection reports from the FDA

- Submitted paperwork for regulatory approval of RI-002, and Bigvam (a legacy product that had been acquired with the Biotest merger).

Only in December of 2018 did ADMA get a notice from the FDA requesting the dreaded “more information” regarding the approval submission for Bigvam. The market automatically assumed the worst and swiftly punished ADMA’s stock price, bidding down the shares by as much as 45% on the frustrating news. The FDA did not deliver any news about the pending application for RI-002; the market just took the Bigvam setback as a bad omen for the whole portfolio.

Why on earth would now be a good time to buy shares of ADMA? They have burned through roughly $45 million during the first three quarters of 2018, and as of their latest report only had about $45 million left in the bank. They have more than $40 million in debt against almost no revenue. There is a chance that their two opportunities to earn revenue quickly (Bigvam and RI-002) could both be denied by the FDA.

But sometimes the risk and the reward are just two sides of the same coin. If novel blood plasma products are so hard to make, then just imagine how valuable ADMA’s factory will be if it does become fully operational.

Apparently the federal government agrees. Biotest AG, the German company that sold ADMA its Boca Raton facility, lately sold it’s entire American blood plasma business to Grifols Inc. As a condition for approval of this sale, Biotest had to take extraordinary measures to make sure that it’s Boca Raton factory would NOT become part of Grifols. In other words, Uncle Sam felt that there is so little viable competition in the blood plasma space, that Biotest had to make sure that Grifols would have at least one viable competitor; ADMA Biologics.

Today, Biotest still owns 45% of ADMA. This provides little ADMA with something of a lifeline should they continue to struggle with the FDA. Biotest AG may be done with the plasma business in America, but they NEED ADMA Biologics to work. Any pipsqueak knows its good to have big friends.

As of the writing of this post, ADMA has responded to all of the FDA’s questions regarding BIGVAM and is awaiting guidance. Separately, the company is expecting an FDA response regarding RI-002 in the April time period. Right now, the market has left ADMA for dead. But wait to see how those shares could come roaring back to life if ADMA finally grasps the holy grail of FDA approval this spring. This stock is NOT for the faint of heart; but if you find an easier way to double your money in just 90 days, let me know…..

For more analysis regarding $ADMA, check out 4 Small Cap Biotech Stocks That Could Double In 2019

DISCLOSURE: The Sick Economist owns shares in ADMA Biologics

Long term prospects are dim thanks to upper level management abusing employees underneath them. Executives need to hone up on their Human Resources before they lose the valuable staff they need to sustain till April and beyond.