This week a young biotech start up called Kaleido Biosciences Inc. became a public company. The baby biotech aims to become a leader in the rapidly developing field of microbiome medicine. We know that there is something critical going on in your stomach; but do you have the guts to invest in this risky business?

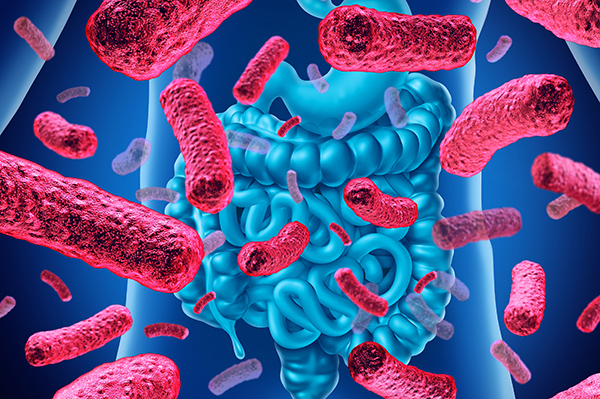

Poor bacteria. They have such a bad rap. All we ever hear is all the trouble they cause, and humankind has dedicated billions of dollars and countless hours of research to the eradication of disease causing germs.

But did you know that only a few bacteria are bad players? In fact, emerging science seems to be revealing more and more evidence that disease causing bacteria are merely a few rogue players in what is typically an orderly and law abiding bacterial citizenry. Think of your gut as New York City. While a few bad players run amuk grab all the attention, in reality your gut hosts a complex and intricately developed civilization that typical works in harmony with the rest of your body. In fact, this harmonious city within your innards is so critical to your own well being that many scientists are now calling your microbiome a human organ, just as vital an integrated to your body as your heart or liver.

In the last few years, thousands of papers have been published in scientific journals presenting tantalizing evidence that all kinds of serious bodily disorders could be fixed by simply restoring order to a microbiome that has somehow gone astray in a sick body. Think of New York City when a traffic accident occurs in rush hour, or the Subways aren’t working. How long does it take for everything else in the city to go sideways?

ENTER KALEIDO

So, we know that important things are happening in our guts; with greatly advanced microscopic technology, smart software and a rapidly accelerating understanding of DNA we are understanding more and more about what is going on in there. Yet, STAT magazine still describes the microbiome as the “Wild Frontier” of medicine. It would take a team with guts to attempt to form a company to create cures for your gut.

This week Kaleido became that team. They are not yet claiming victory on any particular, specific medicine that can restore order to a problematic gut. Rather, they are jumping on the trend of offering investors a “platform” that they will in turn use to crank out medicine after medicine in the mid to long term future.

What do they mean by this exactly? What $KLDO Inc is offering investors is nothing less than a novel way of creating medicines. Think of it this way; they haven’t quite built the bullets yet; they’ve built the gun. And with that gun, they can theoretically crank out different kinds of bullets, for different kinds of targets, indefinitely.

This kind of approach has been all the rage of latey (see, MODERNA, INC), yet somehow poor $KLDO got ignored at IPO time. They actually couldn’t get the price they wanted for their shares, and had to sell more shares to hit their fundraising goal.

This could mean trouble; it could also mean opportunity. First let’s consider the “trouble” theory.

Kaleido isn’t even close to having a viable medicine to sell. Most of their pipeline is pre-clinical, meaning they haven’t even entered into phase I testing yet. The few viable candidates they do have are only in stage 1 testing, with one candidate aiming to enter stage two testing within the next 18 months. For a company that incinerated $46,000,000 doing research last year, that may seem like an awful leap of faith for even the most bold biotech investors.

Also, Kaleido isn’t the only start up attempting to make a buck off of your microbiome. In fact, Kaleido has several sister companies spun off from the same venture capital fund (Flagship Pioneering) that have found the path to profit more arduous than initially hoped. This could have dampened enthusiasm for the IPO.

Finally, there is the fact that even leading scientists don’t fully understand what they are doing. We now have stacks and stacks of published data demonstrating that Kaleido is generally working in the right direction, but ultimately these ballsy scientists are attempting to fly the airplane, while also building the airplane. Feel like putting in a few hundred million, brother?

On the other hand, Kaleido’s less than stellar IPO could really spell opportunity. Simply put, an investor may be “getting in on the ground floor” for a low price. If this platform does come to dominate, you got in cheap. While other “platform” IPO’s have skyrocketed due to media hype and glowing analyst reports, a bold investor may well get a better deal by buying into the platform that was forgotten.

One of the big selling points of Kaleido’s technology is that they may be able to develop real drugs much more rapidly than traditional companies. Our existing FDA process is built around the concept of creating a foreign agent, introducing that foreign agent into the human body, and praying. In this case, Kaleido is merely adjusting an existing microbiome that is out of whack. Think of it like going to the Chiropractor for an adjustment rather than having a surgeon insert metal hardware into your aching back.

The company has already had some success convincing the FDA that their agents should move through the testing/approval process more rapidly than traditional “external” agents; the agent KB195 is skipping straight to phase II, shaving at least 18 months off of the traditional development process. Even the National Institute of Health comments, “A benefit of the microbiome in precision medicine is the ease of manipulation and delivery of therapeutics aimed at modulating microbiome functions.”

SHOW ME THE MONEY

This new, more rapid, concept in drug development means that Kaleido shareholders may not be as far from profit as one would fear. They do have a modest pipeline of drugs that could yield revenue; they have an agent entering phase 2 trials for Hyperammonemia, a rare genetic disorder. The more promising technology would be a related drug, entering phase 2 trials next year, that attacks a similar ammonia related problem in patients with cirrhotic livers. If you have been following the extensive media coverage surrounding NASH research, then you might know that as many as 4.9 million Americans are living with some stage of liver disease; many of whom could benefit from Kaleido’s most advanced line of research.

Furthermore, with the “liver mania” gripping the Big Pharma and Biotech world alike, Kaleido wouldn’t necessarily have to advance a drug all the way to FDA approval to start realizing significant revenue. Companies like Gilead have been steadily building up therapeutic franchises aimed at liver disease, and $GILD is sitting on billions and billions in “dry powder” that they intend to spend acquiring promising startups. In this way, Kaleido shareholders could actually wind up benefiting from the lack luster IPO; a reasonable starting share price could mean a lot of upside when Big Pharma comes a’ knockin’.

Another selling point of Kaleido’s “platform” concept is the idea that the company has a young, but broad pipeline. The liver agents are merely the most advanced candidates. They have a variety of other projects in the works for other, totally unrelated disease states. Perhaps most promising of all is work the company has been doing to confront Multi Drug Resistant Bacteria, a known and growing problem in hospitals around the world. Remember those bad actor bacteria making life difficult for the millions of orderly, law abiding bugs? Well, there just may be a new Sheriff in Town.

The risks are real with Kaleido Biosciences, Inc. But so is the potential. If you are the kind of investor with strong intestinal fortitude, this just might be a good risk to take…

More Stories

5 WAYS THAT BIOTECH CAN ATTACK ALZHEIMER’S

3 PROMISING BIOTECHS FOR THE YEAR 2025

IOVANCE BIOTHERAPEUTICS & GOOD MATH