Guest Post By Phil Kobierowski, an investor and consultant who focuses on the biotech industry.

The journey from lab to pharmacy is long and hard. Biotech clinical trials can be filled with pitfalls and setbacks. But profits await the patient biotech investor. These four small cap biotechs will be presenting data in 2019 that could lead to FDA approval.

As an investor and trader whose focus is biotechnology, part of my job is to profit from share price movements from anticipated events that have a huge impact on small biotech companies – we call these events ‘catalysts’. For small, US-based publicly traded biotech companies these catalysts are typically the release of clinical trial data or FDA regulatory actions such as drug approvals. I continually look for upcoming catalysts in the sector to find those that I feel provide me an opportunity to make a profit.

Below I list several upcoming catalysts expected to occur in 2019 and provide a high-level summary of each. Inclusion is in no way an endorsement or expectation of success. To the contrary, I expect most of these companies or drugs will fail to achieve commercial success. I typically do not hold shares of a company through a catalyst. I do not think of catalysts as an opportunity to bet on their success or failure. Instead I liken the approach of a catalyst as a period when companies get attention from the market who may then consider if their valuations are proper or if they should be revalued. I assess what I think a company should be worth before and after a catalyst and compare that to the market price hoping to profit should the market subsequently decide that it likes my valuation better.

These catalysts are significant, but they are not the only thing that affect stock price. A share of stock represents a share of ownership of a company, not a drug. There are many other factors in the alchemy that comprises a biotech company that often have little to do with the drugs they are developing. Not the least of which are the company’s financial condition, capitalization structure, and the plans of the company’s major shareholders. But, as these catalysts adjudicate themselves, the potential for stock price movement, or unexpected lack thereof, provide opportunities to the investor/trader.

I selected these catalysts as they are all from small companies (market capitalizations less than $500 million) with realistic attempts to impact large medical needs and/or validate technological platforms from which subsequent drugs can be developed. I provide the date range that their respective companies have publicly guided for them to occur and I list them in the order that I expect them to occur. Where applicable I provide a link to each clinical trial in the U.S. National Library of Medicine’s clinicaltrials.gov database.

July 20, 2019. Marker Therapeutics (MRKR). Phase 1/2 Trial Presentation, Pancreatic Cancer.

On July 20, 2019 Marker’s investigators from Baylor College of Medicine will deliver a presentation at the upcoming American Association for Cancer Research’s (AACR) conference. Thus far Marker is touting impressive results in hematological cancers with its multi-antigen, tumor-specific T-cell therapies (MultiTAA). This presentation will give us a first peek at Marker’s progress in pancreatic cancer where new treatment options continue to be desperately needed. Marker’s technology promises to be a simpler, cheaper alternative to the highly publicized, but extremely complicated and costly CAR-T therapies. NCT03192462

2H 2019. GlycoMimedics, Inc (GLYC). Phase 3 Trial Data, Sickle Cell Crisis.

Although there are many high-profile companies developing gene therapy treatments for sickle cell disease, none are in late stage development for the acute treatment of its most disabling symptom: severe pain. This pain is a condition known as vaso-occlusive crisis (VOC) and it occurs when blood capillaries become clogged by the diseased, sickle-shaped blood cells. 100,000 patients a year are admitted into US hospitals for VOS where the administration of opioids is the primary treatment. After four years, GlycoMimedic’s partner Pfizer has finally completed enrollment of the pivotal phase 3 RESET trial to see if their pan-selectin antagonist rivipansel will resolve the vaso-occlusion. Doing so would get patients home sooner while significantly reducing their opioid consumption (the two endpoints of the trial). Success in this trial would validate GlycoMimedic’s unique research in glycobiology and their deep pipeline of other treatments based on it. I anticipate data in July or August. NCT02187003

July/August 2019. Intec Pharma (NTEC). Phase 3 Trial Data, Parkinson’s Disease.

Intec’s “Accordion Pill” technology utilizes multilayer polymeric films that when ingested, unfolds into a shape that prevents its passage past the stomach, allowing it to release its drug into the upper GI track for extended 8-12-hour periods. This would provide a pharmacokinetic improvement for existing drugs that have a narrow absorption window and benefit from long, slow, consistent absorption; drugs such as levodopa, the active ingredient in Intec’s lead asset to treat advanced Parkinson’s disease. The phase 3 ACCORDANCE trial completed its “last patient last visit” in April. The results expected in July or August will go a long way into validating Intec’s gastric-retention technology as a viable drug delivery platform to use for many other existing drugs. NCT02605434

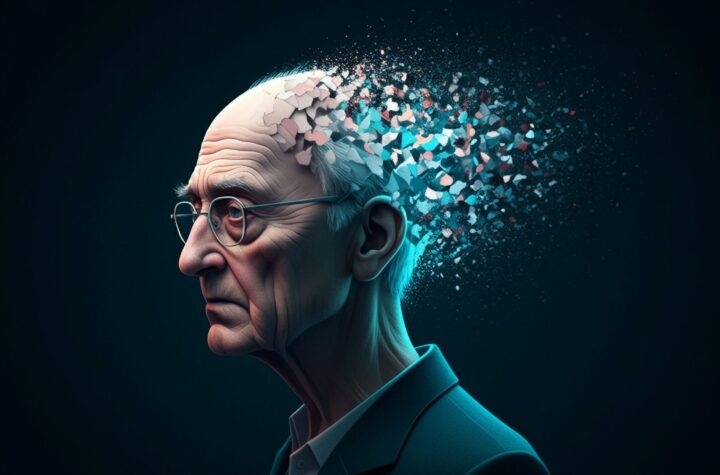

2H 2019. Neurotrope Biosciences (NTRP). Phase 2b Trial Results, Alzheimer’s Disease.

2H 2019. Neurotrope Biosciences (NTRP). Phase 2b Trial Results, Alzheimer’s Disease.

Alzheimer’s disease is arguably the largest unmet medical need in the United States, and it has gone without any significant therapeutic breakthroughs for too long. Industry efforts thus far have mainly focused on plaque accumulation in the brain (amyloid, tau) and that approach has yielded consistent disappointment. Smaller biotechs such as Neurotrope and its marine-derived Bryostatin are addressing alternative pathways to treat the disease. In its phase 2b confirmatory trial, Neurotrope is also notably addressing late-stage patients: a segment typically avoided by the industry in lieu of catching patients earlier where treatment effects could appear more evident. Odds of success are small, but any sign of success, or attention given to a company as small as Neurotrope in such a highly visible medical need would dramatically affect its share price. NCT03560245

This article is not investment advice, it is for entertainment purposes only. Information is to the best of my knowledge, nothing herein is warranted or implied to be accurate or complete. I may own, short, or trade shares of any stocks mentioned anytime.

This NTRP data could be dramatic…so many BACE Inhibitors have failed of late, and this is a totally different approach…

Looks like it’s kind of “all, or nothing at all”

Car-T clearly in early days, like a car in 1910. Hope that Marker moves forward with this…