In the world of medical device stocks, Medtronic is a giant known for it’s strong dividend yield. Equity strategist Kody Kester analyzes the medical equipment manufacturer, aiming to uncover a value stock for our readers…is Medtronic a buy at current valuation?

Guest Post By Kody Kester

As a dividend growth investor, I’m always looking to add to the highest quality names in my portfolio at reasonable prices that will also stand a good chance of meeting my 10% minimum rate of return.

Given that we’re 10 years into a bull market, it’s becoming difficult to find companies that are trading at valuations which give me a good chance of 10% annual total returns over the long-term.

One such name that comes to mind in my portfolio is Medtronic ($MDT). I’ll be discussing why Medtronic is a name in my portfolio, which includes it safe dividend profile with moderate dividend growth prospects, its proven management team, strong business model, and favorable tailwinds.

A Very Safe Dividend With 7-8% Long-Term Growth Potential

When we consider that Medtronic generated non-GAAP diluted EPS of $5.22 in its last fiscal year while paying out $2.00 in dividends per share during that same time, this equates to a payout ratio of 38.3%.

From an FCF perspective, according to page 59 of the company’s most recent 10-K, Medtronic generated operating cash flow of $7.007 billion against capital expenditures of $1.134 billion, for total FCF of $5.873 billion in its previous fiscal year. Against the $2.693 billion in dividends paid to shareholders during that time, Medtronic’s FCF payout ratio works out to be 45.9%.

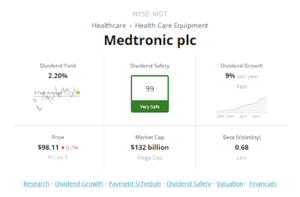

Image Source: Simply Safe Dividends

Unsurprisingly, Simply Safe Dividends and I agree that Medtronic’s dividend is very safe for the foreseeable future.

With that in mind, the next logical step for us would be to determine a reasonable dividend growth estimate going forward.

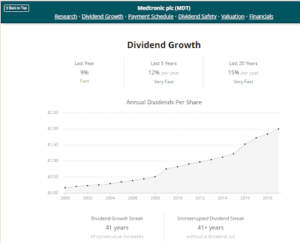

Image Source: Simply Safe Dividends

When we consider that Medtronic’s most recent dividend increase was 8% and the company will likely grow its dividend just a bit more than its earnings in the years ahead, it seems reasonable to conclude that dividend growth will continue to be in the 7-8% range over the long-term.

Further supporting this point is the fact that Yahoo Finance and Nasdaq are forecasting annual earnings growth of 6.9% and 7.1% over the next 5 years, respectively.

Next, we’ll discuss why I believe Medtronic will be able to achieve the earnings growth estimates that analysts have forecasted.

Long-Term Growth Catalysts, A Strong Business Model, And A Proven Management Team

An important consideration for investors is whether the industry a company operates in is positioned to benefit from long-term tailwinds in the future or whether it will endure long-term headwinds.

Like others in its industry, Medtronic will benefit majorly from the projected 5.5% CAGR in US healthcare spending through 2027. As the country and the world around us grows wealthier, larger, and older, the need for the medical devices that Medtronic provides will only increase, which obviously bodes well for the company.

The very nature of Medtronic’s business is what allows the company to possess a strong business model.

Given that Medtronic’s devices are used to treat over 40 conditions and that the company is the largest medical device company in the world, Medtronic possesses a clear competitive advantage over its rivals.

Given that Medtronic’s devices are used to treat over 40 conditions and that the company is the largest medical device company in the world, Medtronic possesses a clear competitive advantage over its rivals.

Furthermore, medical devices are not really an expense a person can compromise on. When your life or your quality of life is on the line from debilitating conditions such as congestive heart failure, you and your medical provider are probably going to seek out Medtronic’s devices to treat your condition.

Adding to the case for an investment in Medtronic is the fact that the company boasts a highly experienced management team.

Omar Ishrak has served as Medtronic’s Chairman and CEO since 2011, bringing with him 16 years of experience at General Electric, most recently as the President and CEO of GE Healthcare.

Medtronic’s Chief Medical and Scientific Officer, Dr. Richard Kuntz has been with the company 14 years, and has served as an Associate Professor of Medicine at Harvard Medical School, Chief of the Division of Clinical Biometrics, and as an interventional cardiologist in the division of cardiovascular diseases at the Brigham and Women’s Hospital in Boston, Massachusetts, prior to joining the company. Lastly, the company’s CFO Karen Parkhill has been with Medtronic since 2016, bringing with her prior experience as the CFO at Comerica, and as CFO of JP Morgan’s Commercial Banking business prior to that.

When we take into consideration that Medtronic is operating in an industry that will likely benefit from the long-term trend of both the US and global population growing wealthier, older, and larger, and the fact that the company possesses an experienced management team, it seems likely the company will continue to remain the preeminent medical device company of the world.

Risks To Consider for Medtronic:

While Medtronic is an ideal dividend growth holding, that doesn’t mean the company is immune to risk. The first noteworthy risk to the company is that the medical devices industry is highly competitive, and an inability on the part of Medtronic to continue innovating, producing products that are safe, cost-effective, and that meet unmet needs, could prove to be detrimental to the company’s long-term growth prospects (page 13 of the company’s most recent 10-K).

Along those lines, Medtronic obviously produces devices whose functioning or malfunctioning is the difference between life or death for the millions of its patients (page 16 of the company’s most recent 10-K). In the event a product line experiences malfunctions, this could damage the company’s reputation among providers, patients, and the general public as a whole. It could also result in mind boggling legal settlements, which would harm the company’s financial results.

Arguably the largest risk to Medtronic is the increasingly complex healthcare environment and growing disdain toward the US healthcare system. A continuation of this disgust and disdain could result in meaningful healthcare reform, which could reduce Medtronic’s reimbursements for products, and also limit the acceptance and availability of its products (page 16 of the company’s most recent 10-K).

While these are just a few of the risks facing Medtronic, I believe they are among the most noteworthy for investors to consider. I would refer interested readers to pages 12-23 of the company’s most recent 10-K for a more complete listing of the risks facing an investment in Medtronic.

The Only Reason I Rate Medtronic A Hold

Valuation matters tremendously and while I believe Medtronic is a fantastic company, it is a bit overvalued to warrant a buy from yours truly. Plugging in Medtronic’s current annualized dividend per share of $2.16, a 10% required rate of return or cost of capital equity, and a 7.5% dividend growth rate, I arrive at a fair value of $86.40 a share. From the current price of $98.11 a share, this represents a 13.6% premium to fair value and shares of Medtronic pose 11.9% downside.

Summary: A High-Quality Company Trading At An Unappealing Price

Medtronic is a Dividend Aristocrat operating in an industry that will almost certainly benefit from a continuation of growth in healthcare spending over the long term. Despite its risks, the company has high quality management and a strong business model that I believe will combat those risks. Unfortunately, the stock price is a bit ahead of itself, and I wouldn’t consider adding until it drops to the mid $80s. At the current price, Medtronic shares offer a 2.2% yield, 6-7% earnings growth, and 1.3% valuation multiple contraction, for total annual returns of 6.9-7.9% over the next decade. At my fair value of $86.40 a share, Medtronic offers a 2.5% yield, 6-7% earnings growth, and a static valuation multiple, for conservative total annual returns of 8.5-9.5% over the next decade.

I consider this an adequate return for a company with the fairly low risk profile of Medtronic.

More Stories

STRYKER & BOSTON SCIENTIFIC: DEVICE DOMINATION

NOVOCURE INC: THE TESLA OF ONCOLOGY?

THE HEARTLESS DICK CHENEY