Guest Post By: Kody Kester of ipreferincome.com

As a dividend growth investor, I’m looking for stocks that are capable of paying reasonably safe dividends that are likely to grow over time.

It just so happens that companies that are able to grow their earnings and dividends over time also tend to meet my annual total return requirements of 10%.

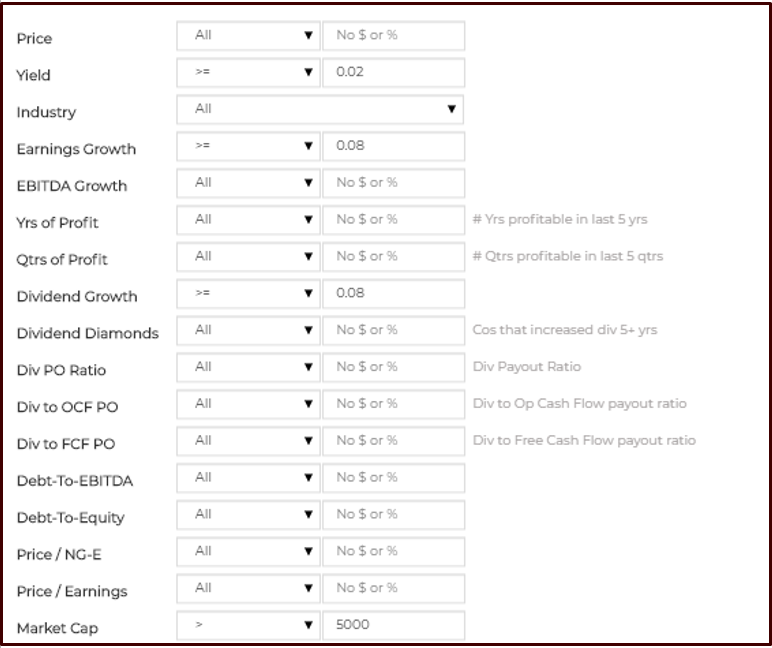

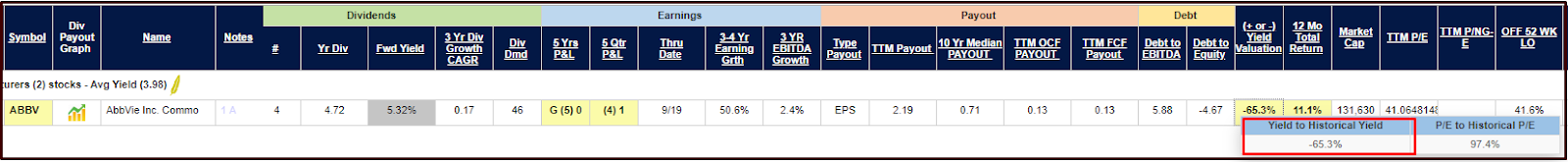

In order to find investments that are worthy of further research, I utilize the “I Prefer Income” programs.

Using I Prefer Income’s dividend, earnings, debt, and payout metrics (and soon to include valuation metrics), I am able to filter for investments that stand a good chance of delivering on my 10% annual total return requirements, so that I can research them further.

Filter Program

(Image Source: I Prefer Income Filter)

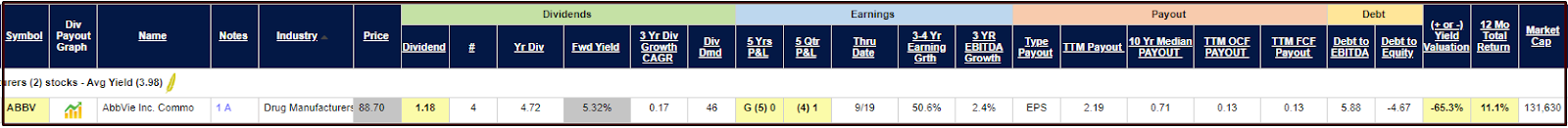

(Image Source: I Prefer Income metrics of ABBV)

One such healthcare stock that comes with an incredible yield and attractive long-term growth potential is AbbVie (ABBV).

I’ll be examining AbbVie’s dividend safety and growth potential, its operating fundamentals/risks, and AbbVie’s current stock price against what I believe to be its fair value.

I’ll then conclude with my annual total return estimate from the current price.

A Fairly Safe Dividend With Room To Grow

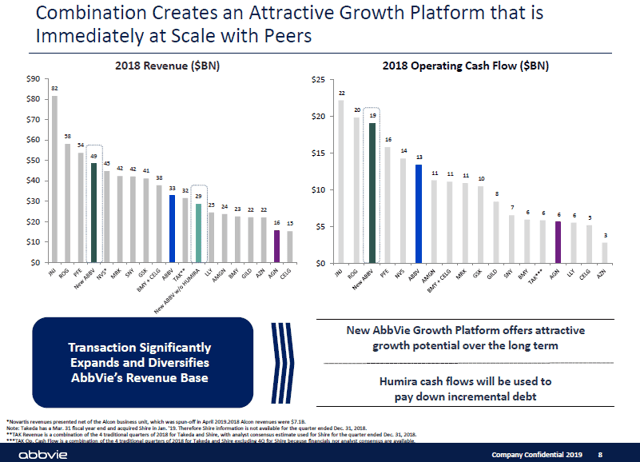

(Image Source: AbbVie – The Combination of AbbVie and Allergan Investor Presentation)

In light of AbbVie’s pending acquisition of Allergan, I thought it would be helpful to briefly examine the payout ratio situation under such situation since AbbVie’s dividend is reasonably safe as a standalone company.

AbbVie CFO Rob Michael indicated in AbbVie’s Morgan Stanley Healthcare Conference Call that a combined company of AbbVie and Allergan would have generated $49 billion in revenues and $19 billion in operating cash flow in each company’s prior fiscal year.

If I take this one step further and use AbbVie’s and Allergan’s combined capital expenditures of a bit less than $1 billion, I arrive at FCF of around $18 billion.

Adjusted for the roughly $1.2 billion of interest expense that will be associated with the acquisition of Allergan as a result of the cash portion of AbbVie’s offer for Allergan, the combined company would have generated $16.8 billion in FCF against dividends a bit north of $8 billion after AbbVie’s most recent 11% dividend increase.

This equates to an FCF payout ratio under 50%, and leaves the combined company with plenty of retained FCF to help pay down the debt that the acquisition of Allergan would add to the combined company’s debt load.

While I wouldn’t expect the combined company to raise its dividend by more than the low single digits as it deleverages in the two to three years following the closing of the acquisition, I do believe that AbbVie is well positioned to deliver mid-single digit dividend growth over the long-term regardless of whether the deal with Allergan is approved by regulators.

The Proposed Allergan Acquisition Is Expected To Be Accretive And Diversify The Revenue Base

\

\

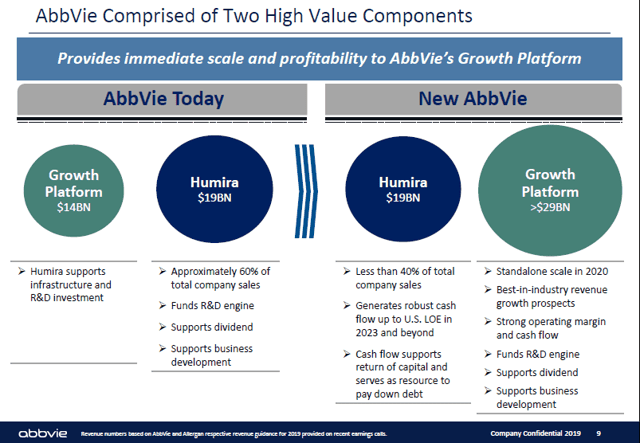

(Image Source: AbbVie – The Combination of AbbVie and Allergan Investor Presentation)

One of the primary benefits of the deal to acquire Allergan is that under the combined company, Humira would account for less than 40% of the combined company’s sales, whereas it currently accounts for ~60% of AbbVie’s total sales.

Given that Humira is set to lose its exclusivity in the United States in 2023 and that it is already seeing a dip in international sales due to biosimilar competition, this is a benefit to the acquisition that can’t be overlooked.

The other key benefit of this deal is that the combined company is expected to boast the strongest growth platform in the industry, with a high single digit CAGR in revenue expected from 2018 to 2023.

These figures are based upon AbbVie management’s prediction that the combined company would be able to realize annual cost savings of $2 billion in the third year after the deal closes, with most of those savings coming as a result of eliminating redundancies in SG&A and R&D.

Another benefit to the acquisition of Allergan, is that the combined company is expected to deliver 10% accretion over the first year of combination, and that is expected to peak at north of 20% a few years after the deal closes.

The acquisition of Allergan would make the combined company’s drug portfolio one of the most impressive in the industry, bringing Botox (both cosmetic and therapeutic), Juvederm, Coolsculpting, Linzess, and Restasis into the mix.

When combined with the fact that AbbVie’s existing commercial drugs are already strong and include fast growing franchises, such as Imbruvica, Venclexta, and Skyrizi, I believe that the future of AbbVie is positioned well regardless of whether the acquisition is approved by regulators.

Risks To Consider

Although AbbVie is a company that I consider to be well-run and that has made shareholders rich since the spin-off in 2013, that doesn’t mean the company is without its share of risks that both potential and current investors must be aware of and monitor over time.

The first key risk to AbbVie is that over the past two years, AbbVie was the price hike leader.

The reason that this is a concern is because of the fact that the industry AbbVie operates in is already under scrutiny over what some believe to be unfair price hikes and business practices.

This could prompt regulators and politicians to enact measures to decrease the profitability of companies such as AbbVie, which could adversely affect AbbVie’s future financial results.

The other key risk to AbbVie is that the combined company may not be able to achieve the expected benefits of the acquisition of Allergan should the deal be approved by regulators (page 39 of AbbVie’s most recent 10-Q).

AbbVie will incur Allergan’s indebtedness, which will increase the risk profile of the combined company in the couple years following the completion of the deal, especially if the legislative risks associated with the industry play out.

In an industry fraught with uncertainty over the actual results of a company’s drug pipeline versus the potential of a drug pipeline, it is entirely possible that AbbVie’s otherwise strong drug pipeline fails to materialize.

If this does occur, it could lead to hampered growth prospects for AbbVie, which could also weigh on its dividend growth potential over the long-term.

While I have discussed a few of the key risks associated with an investment in AbbVie, I certainly haven’t discussed all of the risks. For a more comprehensive listing of the risks facing an investment in AbbVie, I would refer interested readers to pages 10-18 of AbbVie’s most recent 10-K and page 39 of its most recent 10-Q.

Still Priced Attractively In Spite Of The Run Up

Although AbbVie has recovered from its dip below $63 a share following the news of the Allergan acquisition last June, the company is still well off of its all-time high of $123 a share that was reached in January 2018.

With that in mind, I’ll be using a few valuation metrics to determine the extent to which shares of AbbVie are undervalued.

The first valuation metric that I’ll use to arrive at a fair value for shares of AbbVie is the 5 year average forward PE ratio.

According to Simply Safe Dividends, AbbVie’s forward PE ratio of 9.7 is well below its 5 year average of 12.0.

While there are certainly risks associated with AbbVie, such as the near-term loss of exclusivity of Humira in the US and ever present political/regulatory risks, I believe the bearish possibilities are fully reflected in AbbVie’s price at the moment.

Assuming a reversion in AbbVie’s forward PE ratio to 11.5 and a fair value of $105.16 a share, AbbVie is trading at a 15.7% discount to fair value and offers 18.6% upside from the current share price of $88.70 (as of January 4, 2020).

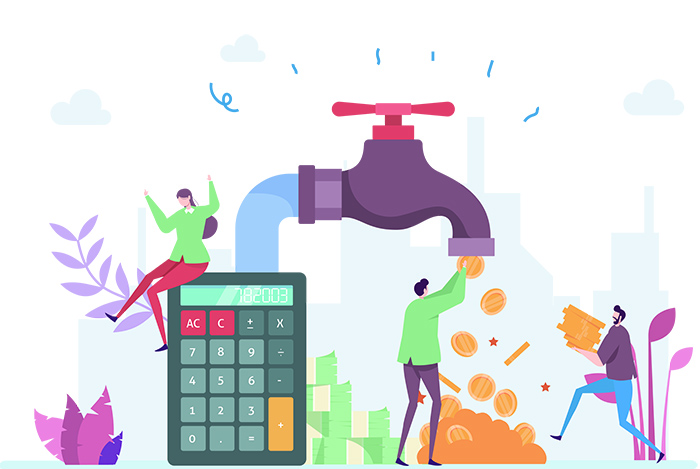

(Image Source: I Prefer Income)

The next valuation metric that I will utilize to determine the fair value of AbbVie’s shares is the historical yield, courtesy of I Prefer Income.

Although AbbVie’s current yield is significantly higher than its historical yield, part of this is reflected in the fact that the company is a riskier investment than it was just a few years ago.

Despite AbbVie’s strong drug pipeline and experienced management team, the acquisition of Allergan and assumption of its debt, along with the upcoming loss of exclusivity on Humira in the US increases the risk profile of the company.

As such, I believe a reversion to a yield of 4.5% and a fair value of $104.89 a share is a reasonable approximation of AbbVie’s fair value.

This indicates that shares of AbbVie are trading at a 15.4% discount to fair value and offer 18.3% upside from the current price.

The final valuation method that I will use to assign a fair value to shares of AbbVie is the dividend discount model or DDM.

(Image Source: Investopedia)

The first input into the DDM is the expected dividend per share, which is simply the annualized dividend per share. In the case of AbbVie, that amount is currently $4.72.

The next input into the DDM is the cost of capital equity, which is the rate of return that an investor requires on their investments. My personal preference that I’ll use for the sake of valuing AbbVie is 10% because I believe a 10% annual total return is an adequate reward for the time and effort that I allocate to researching and monitoring investments.

The third input into the DDM is the long-term dividend growth rate or DGR.

Unlike the first two inputs that require very little time or consideration to plug into the DDM, the long-term DGR requires significantly more time to accurately forecast.

This is because investors must factor in a company’s payout ratios (and whether they are likely to remain the same, expand, or contract over the long-term), earnings growth to support dividend growth, industry fundamentals, and the strength of a company’s balance sheet.

Given that AbbVie is expected to grow its earnings 3.7% annually over the next 5 years according to Yahoo Finance and that the payout ratio is in an ideal range, I would expect 5% long-term dividend growth.

When I consider AbbVie’s past earnings growth, I believe the 3.7% estimates are a bit too low in spite of AbbVie’s challenges that lie ahead.

I would expect earnings growth of around 5% over the long-term, which would easily fuel like dividend growth.

Using the above assumptions, I arrive at a fair value of $94.40 a share for AbbVie.

This implies that shares of AbbVie are trading at a 6.0% discount to fair value and offer 6.4% upside from the current price.

Averaging the three fair values together, I arrive at a fair value of $101.48 a share, which means that shares of AbbVie are trading at a 12.6% discount to fair value and offer 14.4% upside from the current price.

Summary: AbbVie Offers A Market Crushing Yield And Possesses A Solid Drug Pipeline To Fuel Future Dividend Growth

As a result of its spin-off from Abbott Labs (ABT), AbbVie is a Dividend Aristocrat. The company’s dividend growth since the spin-off in 2013 has been nothing short of incredible.

Despite the risks surrounding Humira and the usual regulatory risks associated with the industry, AbbVie’s management team and drug pipeline appear poised to deliver the earnings growth necessary to fund mid-single digit dividend increases over the long-term.

Bolstering the case for an investment in AbbVie is the fact that the company is trading at a 13% discount to fair value.

Between its 5.3% yield, 5% annual earnings growth, and 1.4% annual valuation multiple expansion, AbbVie offers annual total returns over the next decade that are likely to exceed my 10% annual total return requirement, while also offering a yield nearly triple that of the S&P.

It is for these precise reasons that I am long AbbVie and believe it is among the very best investments for investors that are looking for a blend of immediate income and dividend growth.

More Stories

HOW TO NAVIGATE BIOTECH INVESTING DURING THE 2020 ELECTION

CRUISE INTO SUMMER 2020 WITH THIS HOT BIOTECH STOCK

UPDATED: OUR #1 BIOTECH STOCK FOR 2020