It’s one of the worst scenarios that you can imagine. It’s 2:00 AM and you are sleeping. The peace and tranquility of your happy home is assaulted as your phone begins to ring at an inappropriate hour. Startled awake, you answer the phone in a groggy tone. A stranger at the other end of the line tells you that a loved one has been in a car accident.

An electric bolt of shock shoots through your body as you receive the upsetting news. However, your next response is natural. You ask questions. Is your loved one still alive? What condition is she in? Who else was hurt, and how bad? What was the situation around the crash? What prospects for recovery exist? After suffering the initial shock of the bad news, it’s only logical for you to begin to ask questions. You are trying to process facts, and to plot a path forward.

If you own biotech stocks, by now you have received the bad news that the biotech car has crashed. Badly. XBI, a broad index of young biotech stocks, has tumbled from $147 just one year ago, to as low as $80. Within that index, many of the less established companies have lost 50, 60 or even 70% of their stock market value. This sector of the market has crashed and burned. Now our next step is to ask some logical questions, explore answers, and create a viable action plan. The following Q&A is designed to help you process what has occurred, and to help you take the best financial path for you.

Why did the Biotech Sector crash?

There are three main reasons why the biotech sector crashed. The first reason is interest rates.

It may seem like changing interest rates should not affect the biotech sector, because most young biotechs carry little debt and the dynamics of young biotechs are very different from most cash flowing, mature companies. While this thought is logical, it fails to appreciate the larger, or “macro,” view.

In the “macro” view, all investors, large and small, sophisticated and beginner, world wide, have a wide range of options to invest their capital. Over the last few years (but, really, since 2008), interest rates in developed countries have been very, very low. This effectively eliminated a whole world of interest bearing investment options such as government bonds, corporate bonds, and even simple, old fashioned, interest bearing bank accounts (remember those?) This had the effect of making more risky, more long term, investments more appealing. It makes more sense to take a risk to earn large returns tomorrow, when your options for earning a certain return today are virtually nil.

Now, due to raging inflation, the process is going into reverse on a grand scale. Interest rates are going up throughout the entire developed world. Suddenly, investors will have a choice again. Do they risk their hard earned capital on a profitless biotech that might earn big bucks in the far future? Or do they plunk it down into something secure and start earning interest today? Many will choose the suddenly available safer option. This removes potentially millions of investors from the biotech market.

The same has happened to risky, “speculative” stocks across the entire financial universe. Cathy Wood, proprietor of the now infamous ARKK innovation fund, has seen her fund lose half its market value in the last year. In this rapidly changing financial environment, risky stocks are suddenly ice cold.

The second reason why the biotech sector crashed is because Wall Street has been enabling excessive risk in the sector for years. Traditionally, biotech companies only went public when they had a mostly established molecule, had revenue, and were at least getting close to profit. In the last few years, the scene got so crazy that many companies were going public with just a few patents and a lot of prayers! In 2011, just 8 biotech companies went public. In 2021, 96 entered the public markets! Many of these companies are simply too young, too immature, and should have remained in the “incubation” stage, before being exposed to the harsh light of public scrutiny.

The third reason why the biotech sector has crashed is simply because…..these things happen. Any high-flying sector, whether it be new innovations in software, new kinds of AI, or new biotechnology, is inherently risky and volatile. Nasdaq has done so well, for so long, that many forget that even today’s market darlings such as Amazon.com, once lost 90% of their value in a crash. If you want to aim for the potential outrageous benefits that can come from innovation stocks, you need to realize that volatility comes with it. There is no reward without risk.

Will the Biotech Sector likely bounce back soon?

Nobody has a crystal ball, but the honest answer is……”probably not.”

Although no one knows for sure, history suggests that crashes of this magnitude require some time before the market heals itself. For example, when the Nasdaq market crashed in 2001, it took around ten years for the market to regain its previous highs.

There are a few reasons for this. If you are feeling fear and loathing after reading the above statistic, that is the first reason why rebounds take time. In the case of the Nasdaq crash of ‘01, a whole generation of high flyers was burned to a crisp. While some wise ones learned their lessons and came back as more experienced, mature investors, too many ran away screaming and missed out on all of the eventual profits. The hard truth is, the same is likely to happen with the biotech sector today. For XBI to fly to the same levels as it hit just a year ago, we will probably need a whole new generation of young investors to get excited all over again.

The other reason why the biotech sector is unlikely to rebound sharply in the near future is that it may not be done crashing yet. As harsh as the last year has been, we are only in stage I of the unfolding drama. Right now, many companies are “Dead Men Walking.” They have lost most of their stock market value, but are still bravely chugging along with their scientific investigations. But many were underfunded, having gone public with the assumption that they could easily raise more capital at any time. Now that “the thrill is gone” from the sector, many, many young biotechs will find the funding spigot stuck in the “off’ position. The crash always comes first; it takes about 12 to 18 months for immature young biotechs to start running out of cash. Then they will start dropping like deer that couldn’t make it through the winter.

The last reason why a biotech rebound is probably not imminent, is that we are still in the early stages of the interest rate process that was described above. The Fed just now stopped buying bonds to repress interest rates. The Fed just made their first baby steps with a tiny increase in interest rates. Many reputable economists believe that much larger interest rate increases will be required to bring raging inflation under control. While it’s not impossible over the long term for biotech and high interest rates to co-exist, in the short term, we are still looking at an economy in shock as the fundamentals for the last 15 years evaporate.

What are the Characteristics of Biotech Companies that are Likely to Survive the Mayhem?

You may have noticed earlier, I used the example of Amazon.com, which at some point during the Nasdaq crash of 2001, lost 90% of its value. Of course this situation is the stuff of legend. Amazon did not merely survive, but Amazon thrived, earning a shocking 31,472% return for anybody who bought the company at its lows.

Plainly stated, when the market enters into a panic, the baby often gets thrown out with the bathwater. The entire sector falls out of favor, and lots of great young companies get lumped in with the losers. Depending on your capital position, your mental disposition, and your skill level, you may be able to select some real world beaters right now.

There are a few important characteristics you should be looking for right now in a biotech stock that has crashed. First and foremost, is cash. As the saying goes, “ain’t nuthin’ goin’ on but the rent.” It was all fun and games during the last few years, when just about anyone with a test tube could wish upon a star and millions in funding would pour out of Wall Street. Those days are likely done. Many companies with good research will starve before the science ever comes to fruition. You want companies that have at least two years worth of cash on hand. If they have more cash on hand, even better. Scientific breakthroughs take time and patience. You want to make sure your target companies have the financial strength to complete the marathon.

You also want stocks that are fully formed companies. As mentioned above, over the last couple of years, there was a tsunami of biotech IPOs, and many of those little companies were really still embryos, not yet ready to be born into the world. Now, with funding cut off and Wall Street analysts much more skeptical than before, these proto-companies are likely to become divisions in someone else’s larger, more established corporation, or to fade away altogether. You need to look for companies that have viable molecules in phase 2, or, even better, phase 3 trials. Meaningful revenue shouldn’t be a vague notion. Once again, paying the bills and keeping the lights on become priority number one in today’s tougher environment.

Lastly, if you find the courage to invest in small companies while everyone is panicking around you, look for little companies with big friends. Many of the most promising biotechs today have signed and operational partnerships with major players. This lends the science some credibility, and more importantly, it provides the start-up financial support. It’s easy for a multi billion dollar pharmaceutical giant to throw a lifeline to a promising biotech partner if the sailing gets rough.

Biotech is on sale. If you make the right moves now, you may just score yourself the deal of a lifetime.

What Should I do if I Hold a Biotech Stock that has Lost 80% of Its Value?

Right now, even the best biotech investors are witnessing scenes of carnage if they are brave enough to review their portfolios. If an investor has two or three stocks in the black on a ten stock portfolio, she is doing well. Many names will be down 20%, 40%, or even 80%.

What to do about these really beaten down stocks? The number one thing you should not do is panic! Don’t assume that, just because the market is down on a company right now, that your original investment thesis is invalid. Rather, try a triage system where all of your losing biotech stocks are carefully re-evaluated and placed into one of three groups.

The first group are the stocks that really are now the walking dead. Everyone has a few of these. These would be names where something fundamental about the investment thesis has changed in a negative way. Maybe a certain trial yielded disappointing results. Maybe they have had three CEOs in a year. Maybe their market capitalization has shrunken so badly that they barely even belong on public markets any more (for example, market capitalization less than $100 million, or a share price of less than $2).

This group needs to be put out of their misery. Sell them, take the loss, and use the loss as a tax write off. Try to evaluate what went wrong, and put the experience down to tuition paid at the university of life.

The second group are companies that seem to be in a tight spot at the moment, but nothing fundamental has changed about them. Their clinical program is still on track, their leadership still retains your confidence, and they probably have enough cash to continue to move their agenda forward for at least the next year. This group, just leave be and pray for the best. Check back towards the end of the tax year; if their situation has grown materially worse, then sell them and use the loss to shelter profits you made elsewhere.

The last group are the real diamonds amongst the coals. These are companies that have lost stock market value for no real reason. Nothing fundamental about their situation has changed, they remain on solid footing financially, and the clinical rationale for their existence is still valid. In the current panic, they have just been marked down with the rest of the sector. Think Amazon.com, circa 2002. For these few select “diamonds in the rough,” buy more! The way you make money with stocks is to run into the burning house, when everyone else is running away. Yes, you could get scorched. But the biotech game has never been for the faint of heart.

Why not Just Sell Everything and Walk Away?

You aren’t alone if you are asking yourself this question. A lot of people have asked themselves this question after various crashes over the years. In the case of biotech stocks, there are some very solid reasons to stay in the game, no matter what.

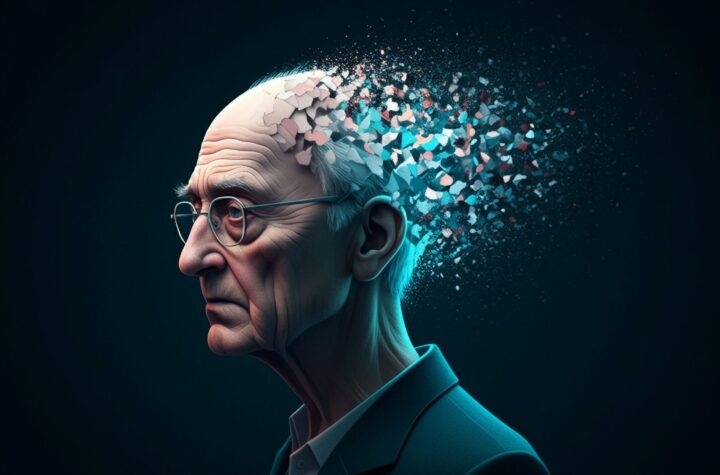

The first reason is global demographics. In America, 10,000 people per day age into our Medicare program. And we are one of the “younger” developed countries. The over 85 age group is the fastest growing age group in the developed world. None of this is natural. Just a century ago, the average lifespan in America was 40 something years old. Americans just keep getting older and older, and that means a vast, unquenchable desire for biological innovations to keep people going. The only sector that could address the fundamental human longing to live forever is biotech.

The second reason to keep going is math. Now isn’t the worst of times for investors. Now is the best of times. Even Homer Simpson knows that the secret to stock market success is to, “buy low, sell high.” Traditionally, the challenge has been that it’s not so easy to see when we have hit “low” in the markets. Now we have hit “low” in biotech. Very low. It’s very, very likely that the XBI index will be dramatically higher in ten years. Now isn’t the hardest time to invest. Now is the easiest time.

The last reason to keep going is your competition is all running for the exits. Buyers today don’t have much competition.

You might not have thought of stock market investing as a competitive sport, but it is. Sure, there are no scoreboards, no footballs, and no post game interviews. But the acquisition and ownership of attractive assets is indeed a competitive affair.

Think of it this way: you have your eye on Science X corporation (a made up name). They have a bunch of promising trials, their CEO is all over the news, and Jim Cramer, between belching out his opinion about a radiator company and a fast food company, declares that Science X is a “buy.” Demand for the company’s shares goes sky high. But there are only so many shares. The number of shares is limited, and scarce. You will have to compete directly with other potential buyers if you want to land your slice of this market darling.

But now all of the tourists and cable news cowboys have taken what little capital they have left, and fled. They are moving into other, “safer” sectors, or are putting everything into cash and heading to the bar to cry into their beers. Suddenly, nobody is interested in interviewing the CEO of Science X corporation on TV, Jim Cramer acts as if he’s never heard of the company, (let alone recommended it); certainly no one is talking about upcoming clinical results.

This is the equivalent of you catching the football, and finding nothing but open grass in front of you. There are no defenders keeping you from the endzone, because they have all moved into another area of the gridiron, where they thought the action would be. In this case, the only one who can stop you from scoring a touchdown is yourself.

I Got Burned Badly. How Do I Manage Risk in the Future?

Less competition or not, right now you may just be staring at all the red in your biotech portfolio and wondering, “where did I go wrong?”

As we discussed, your “wrong moves” may just be temporary, or they may just be a prelude to a new era of unfettered opportunity. But, it’s actually not a terrible question to ask yourself, “where did I go wrong?”

Asking yourself that question, in a positive and non-judgmental way, is the best way to learn. And the only way to learn, sometimes, is to take your beatings. The number one factor that separates the successful long term investor from some poor guy who never managed to accumulate much, is the ability to view mistakes as learning opportunities. If you view your current mistakes as learning opportunities, you will have a chance to eventually come back stronger and wiser. If you are too hard on yourself, or decide that stock investing is some kind of scam dreamed up by an elite core of rich people, then you are committing yourself to stay poor.

If you have lost most of your money, the first mistake is: you were too aggressive. Well, aggressiveness might not be the only problem. You also may have been too optimistic, or even (hate to say it) too gullible. You believed certain fantastical claims that just weren’t true. Or you had never really seen a sector crash like the biotech sector just has. That doesn’t mean you can never believe an optimistic claim again, and it doesn’t mean that you shouldn’t be aggressive at times!

If you lost most of your money this time around, it means that you need more diversification next time, and more caution. Verify claims and study up. Don’t put all your money in young, start up businesses with big dreams and small revenues. Keep a certain amount of your money in big, reliable stocks like Big Pharma names, or even diversify into bonds or real estate all together.

The other consideration is, you may not have “lost” very much at all. Just because you are currently staring at a sea of red, doesn’t mean your overall portfolio will stay red forever. We are currently experiencing some particularly rough sailing. Yes, some companies will be total losses. Many will limp along for a long time, slowly regaining lost market value. A few will rocket to greatness, like Amazon did. Use the triage process described above, and don’t assume the worst without really verifying that the worst has occurred.

Hopefully, I have answered a lot of the most urgent questions that the recent market volatility has raised. The stock market game has been going on for hundreds of years, and every kind of asset in the world traded hands all over the world for thousands of years before that. We never finish learning. With a little luck, and a lot of courage, this year’s biotech route will wind up being just one chapter in your long and fruitful stock market story.

left out an important point, most biotechs are scams, pump and dumps, the funny thing is a lot of the “scientists” who work at these places are too naive to see it or they’re desperate for a job so they play along. Remember, it’s next to impossible to find work with a PhD in bio or chem, no one will ever speak up about it.

Now that doesn’t mean you can’t get rich playing these stocks but even the so called “success stories” produced nothing but garbage of questionable utility hyped with hoopla.

Sorry, I worked in the industry for years, they’re a pack of liars