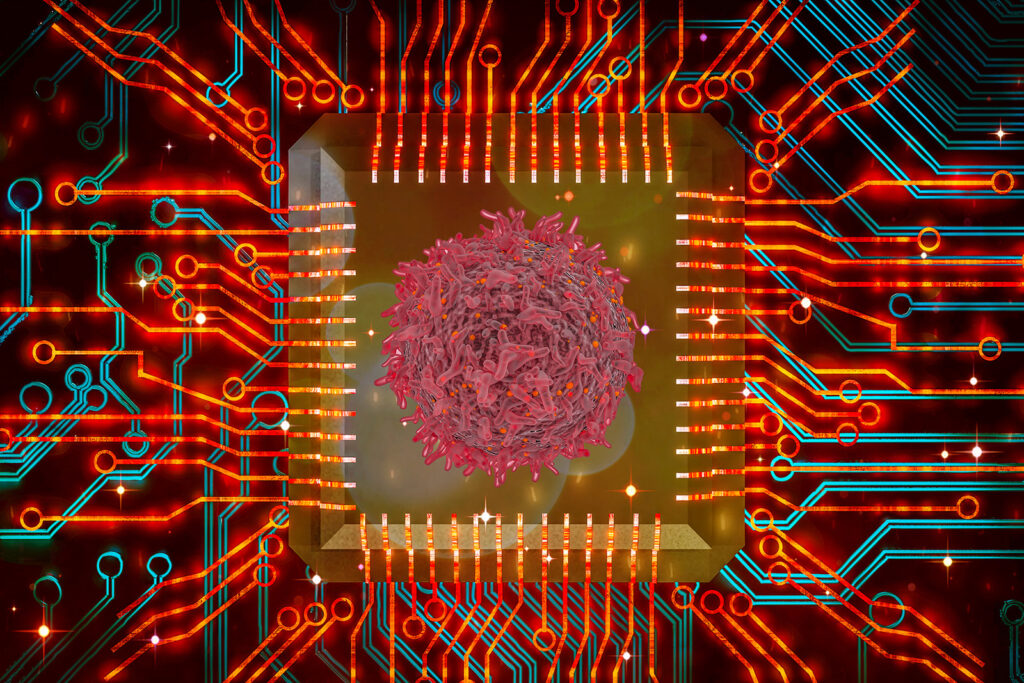

Compugen Limited ($CGEN) is a growing oncology company that exists at the nexus between information technology and biology. Can the company’s advanced computation become a money machine for investors?

By The Sick Economist

Imagine for a minute that you own the hottest nightclub in town. The ambiance is sheek, you attract top DJs from around the world, and most importantly, the crowd is very select. Everyone has heard about your club, and everyone wants to get in. But not everyone can get in. Why? Because you have a team of security personnel that make sure that only those who belong in your carefully curated ecosystem may enter. Not only are your doormen very selective about who can enter the club, but if they catch anyone misbehaving, they quickly eject the troublemaker.

But imagine for a moment, that some troublemakers are so pernicious that they come in disguise. Not only can they gain entry into the club, but sometimes they set up residence there and proceed to do all kinds of bad things that hurt the atmosphere; they deal drugs, they harrass women, and they steal liquor. Even worse, if they find the environment friendly to their bad behavior, they invite bad friends, and soon the whole club goes downhill. Your bouncers are constantly scanning the club, looking for those uninvited, out of control troublemakers, but for some reason, they fail at their mission. These troublemakers are so well disguised in your club that they evade security until it’s too late; soon the whole club has been ruined.

This is basically what happens with cancer. These days we hear so much about our immune systems due to the Covid-19 Pandemic. But did you know that your immune system is also constantly battling cancer? In most healthy people, the immune system is so efficient that tiny malignant growths, sometimes of just a few hundred cells, are removed before any trouble ever begins. But every once in a while a band of malignant cells sets up shop and grows out of control; the immune system is simply helpless against the impending disaster.

In the last twenty years, it has become abundantly clear that our immune systems play a critical role in the pathology of cancer. That is why drugs like Keytruda and Opdivo, known as immunotherapy, have become lifesaving breakthroughs for thousands of patients. These drugs have had some success in “re-awakening” an immune system that had been sleeping on the job. Many patients have seen tumors melt away faster than an ice cube on a hot summer day.

These new immunotherapies have been a great first step, but sadly, they still don’t work in the majority of patients. Johns Hopkins University estimates that overall patient response rates to immunotherapy are only between 15 and 20%.

Compugen, a small biotech headquartered in Israel, is looking to change the game by greatly improving those statistics. Compugen leverages proprietary software and information technology to find new targets, or “pathways,” where cancer can be attacked. They specifically focus on improving immune response to cancer.

Compugen seeks to discover novel pathways that may respond to new immunotherapies, and then seeks to pioneer the early studies that establish promise for these agents. Then the small company partners with larger, more established Big Pharma companies to complete the commercialization process. This little company is aiming to make big progress in helping your body’s security team remove unruly guests before they can cause serious harm.

The Compugen Approach

Although Compugen is a small company with less than one hundred employees, it’s not quite accurate to call it a “start-up.” $CGEN started out in life just as an IT operation that only crunched data to look for oncology drug targets. The company’s current leader, Dr. Anat Cohen-Dayag, has actually held various leadership roles at the company for almost two decades. However, as our understanding of immunotherapy has evolved and grown, so has Compugen. Today the company has at least four active, phase I trials with several different agents; Comugen also has active collaborations with pharmaceutical heavy hitters such as Bayer, Bristol Myers Squibb, AstraZeneca, and Johns Hopkins University.

The prestigious collaborations and four ongoing trials are solid proof that Compugen’s approach is working. However, anyone who has been in this business long enough knows that phase I is still very early in a drug’s development lifecycle. Only 20% of drugs in phase I ever make it to market. Once they enter the market, the newly approved drugs may, or may not, achieve commercial success.

The value of $CGEN lies not in the product, but in the platform. Their digital platform has already produced several clinical research programs. You can think of the IT platform as the Goose that Lays the Golden Eggs. Each individual egg is shiny and valuable, but it is the goose herself that should be prized above all.

Compugen’s digital platform could produce golden eggs at a growing rate. We all know that raw computational power grows at an exponential rate. Some experts believe that our Artificial Intelligence could improve more rapidly in the next ten years than it did in the previous hundred years. Most importantly, the data itself is rapidly improving. Currently thousands of trials related to cancer immunology are being conducted all over the world, producing millions of data points. Data related to human genetics is also exploding in volume. It’s possible that Compugen will crunch more data and get better results in the next two years than it did in the previous twenty years combined.

The Numbers

So Compugen may well have a bright future ahead of it. But right now, the company still doesn’t make money. Even with a $1 Billion capitalization on the Nasdaq stock exchange, the company could still be considered gestational.

The business may have to invest for several more years before a chance for positive cash flow exists. The good news is that the company is currently well equipped to do just that. When the $CGEN handed in its latest financial report, the company had burned $7.8 million in one quarter of operations, but still had $133 million on hand. This would mean the firm can conduct its research and experiments for several years without having any trouble paying its bills.

These numbers also mean that the company’s pipeline and cost structure justify it’s current $1 billion market capitalization. Remember, statistically speaking, one out of five stage I drugs make it to market. Currently the company has four active phase I trials, with more on the way. That would mean that it’s odds of bringing at least one product to market over the next five years are pretty good. Cancer is big business; a successful agent can easily post annual sales of $1 billion or more. A commercial stage biotech can often trade at 8 times it’s annual sales. So, if just one of Compugen’s drugs makes it to market, and does $1 billion in annual sales, the company could achieve a market capitalization of $8 Billion. That would mean a cool 800% gain for an investor who got in at today’s share price.

Additionally, it should be noted that several of the company’s research products are aimed at increasing the efficacy of already existing best sellers such as Opdivo and Keytruda. These agents are already very well established pillars of oncology, even though they work less than 50% of the time. Any agent found to substantially increase efficacy of a drug that already sells billions could also sell billions. If one of Compugen’s new pathways is found to boost the efficacy of Opdivo or Keytruda, the company could trade for much more than $8 billion almost overnight.

Apparently other investors have also found these numbers to be appealing. The firm’s largest shareholder, owning almost 30% of the outstanding shares, is Ark Invest. Ark Invest has received oceans of media attention and adulation of late for the stellar returns that they have delivered for their investors. Cathy Wood, the leader of Ark Invest, is a media darling well known for aggressive forward thinking regarding technological breakthroughs. She’s betting big that Compugen represents one of those breakthroughs.

Compugen is an example of a biotech pioneer that could be a great investment for a patient investor with a stomach for risk. This upstart company is utilizing the latest 21st century technology to evict an intruder who has been unwelcome in the human body for milenia. The stakes are high, both for investors and the human race.

Note: The Sick Economist owns shares in $CGEN

More Stories

5 WAYS THAT BIOTECH CAN ATTACK ALZHEIMER’S

3 PROMISING BIOTECHS FOR THE YEAR 2025

IOVANCE BIOTHERAPEUTICS & GOOD MATH